Sub‑Saharan Stablecoin Series – Introduction

Sub‑Saharan Africa’s crypto frontier is alive and buzzing. In this series we’ll visit several countries, but first we need context: why does the idea of saving with a digital dollar (a stablecoin) resonate from the Cape to the equator?

A youthful region hungry for technology

Sub‑Saharan Africa isn’t just growing; it’s bursting with youth. United Nations data points out that more than 70 % of the region’s population is under 30 years old, and Africa’s median age is just 19.3 years. Urbanisation is around 45 % and rising fast. This huge, energetic population is jumping straight to mobile phones and the internet:

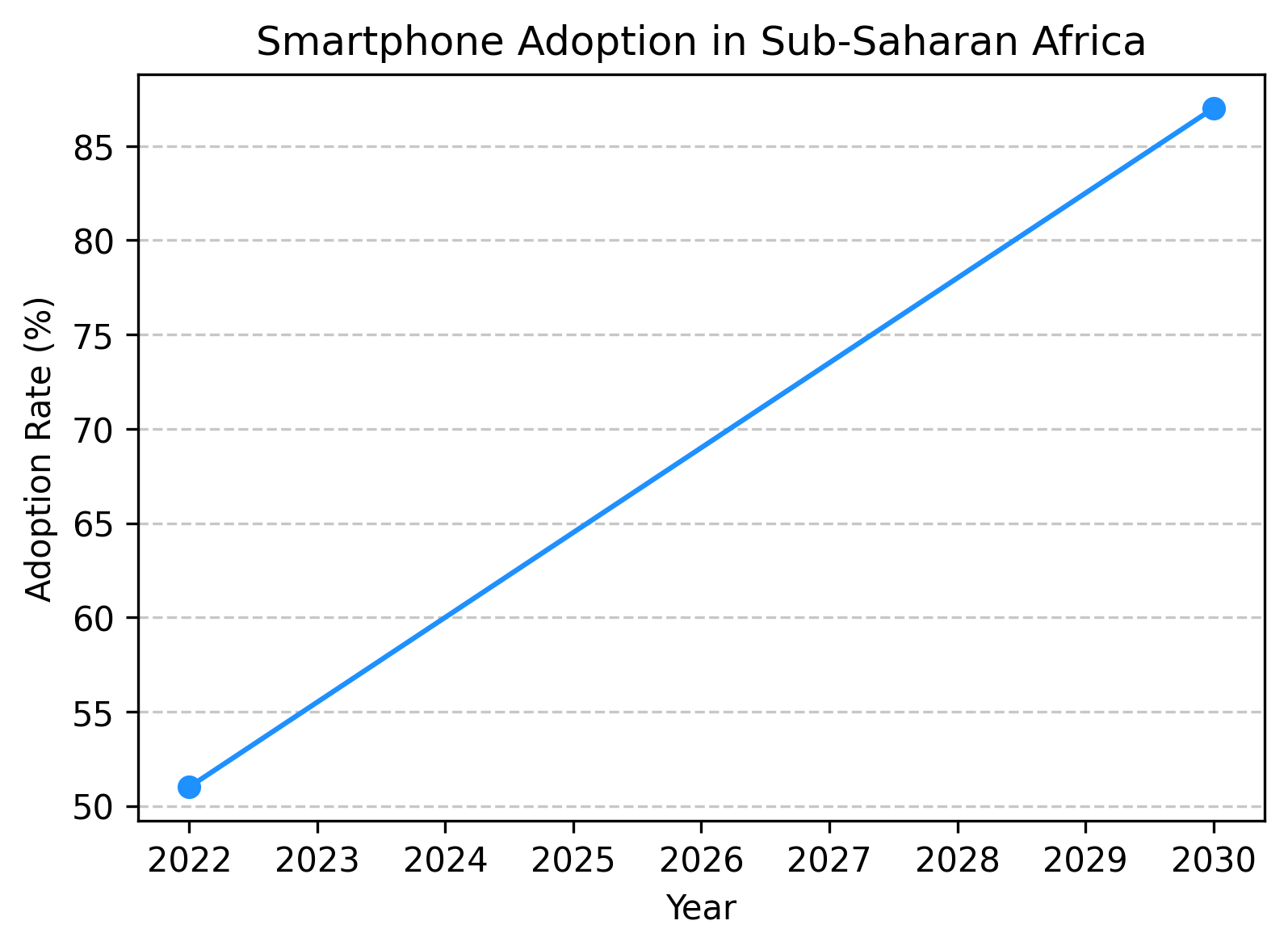

Smartphone adoption is exploding. According to GSMA’s mobile economy report, smartphone penetration reached 51 % in 2022 and is projected to hit 87 % by 2030; this means nearly every young person will hold a supercomputer in their hand. Smartphone numbers in the region could jump from about 540 million devices in 2024 to 880 million by 2030, with data consumption per phone tripling. A closing gender gap (the ownership gap narrowed from 28 % to 25 % between 2023 and 2024) suggests technology is reaching everyone.

These devices unlock access to mobile money (think M‑Pesa) and digital markets. But to send money abroad still costs a fortune.

The remittance dilemma

Sub‑Saharan Africa’s diaspora sends tens of billions of dollars home every year. Remittance flows reached roughly US$56 billion in 2024, with Nigeria alone accounting for $19.5 billion (38 %). Yet sending money here is the most expensive in the world; the World Bank notes that moving $200 costs about 7.9 % on average and that even the global average is 6.4 %. Digital channels are cheaper (around 5 %) than traditional ones (7 %), and mobile‑operator remittance services cost just 4.4 % – but those channels are still limited.

High fees incentivise people to look for alternatives. That’s where stablecoins come in. These crypto tokens track the value of a real currency (often the US dollar) and can be sent cheaply across borders. Mercy Corps found that a stablecoin‑powered remittance pilot cut fees from 29 % to just 2 %, making cross‑border transfers almost instant. No wonder folks are paying attention.

Rise of stablecoins and crypto culture

Africa’s relationship with crypto isn’t just remittances. A Milken Institute study notes that stablecoins account for roughly 43 % of all crypto transaction volume in Sub‑Saharan Africa. Nigeria, Africa’s largest economy, saw US$59 billion in crypto transactions in 2024, and stablecoins make up about 40 % of its crypto market. They’re used for:

Cross‑border payments by small businesses who can’t access formal banking.

Savings and hedging against inflation – storing value in US dollars is attractive when local currencies depreciate.

Peer‑to‑peer commerce – paying for goods and services on social media or local marketplaces.

Many governments have tried to introduce Central Bank Digital Currencies (CBDCs) like Nigeria’s eNaira, but adoption is low (98 % of eNaira wallets were inactive in 2023). Private stablecoins fill the gap because they work across borders without bureaucracy. However, regulatory uncertainties and the fact that over 100 million people in the region lack official ID documents hamper wider adoption.

Macro‑economic backdrop

The region’s economies are improving, but slowly. The World Bank’s April 2025 Africa’s Pulse report projects real GDP growth of 3.5 % in 2025, rising to 4.3 % by 2027. Inflation is cooling; the median inflation rate fell from 7.1 % in 2023 to 4.5 % in 2024. However, per‑capita incomes remain about 2 % below their 2015 peak, and job creation hasn’t kept up with the population surge. To many young Africans, saving in local currency feels like pouring water into a basket – it leaks value.

Why stablecoins make sense here

Put yourself in the sandals of a young entrepreneur in Lagos, Nairobi or Harare. You need to import goods from abroad, pay remote freelancers, or send money to relatives in the diaspora. Traditional banks ask for stacks of paperwork; money transfers take days and 10 % of your funds vanish as fees. Meanwhile your local currency is losing purchasing power each week.

Stablecoins solve these pain points:

Speed & affordability: Transfer US$10 to a family member in seconds, paying cents in fees instead of dollars.

Stability: Keep savings in a dollar‑pegged token to escape double‑digit local inflation. In volatile economies like Zimbabwe (inflation 172 % in 2023) or South Sudan, that’s a lifeline.

Financial inclusion: You just need a mobile phone and internet – no bank account. As smartphone adoption climbs to 87 % by 2030, billions of people could access digital dollars.

Smartphone adoption is set to surge, while remittance costs remain high. Stablecoins provide a digital bridge.

Headwinds to watch

Of course, no story in Africa is complete without twists. Governments worry about capital flight, money laundering and loss of monetary control. Some have banned or restricted crypto trading, only to see thriving black markets emerge. Infrastructure gaps – unreliable power, patchy internet, high data costs – limit access in rural areas. The region’s digital identity gap (100 + million people without IDs) complicates compliance with anti‑money‑laundering rules. And volatility in crypto markets means that not all digital coins are created equal; stablecoins must maintain their peg for trust to build.

Conclusion and road ahead

Sub‑Saharan Africa is young, connected and hungry for financial tools that work for them. High remittance fees, weak local currencies and bureaucratic banking systems push people toward innovative digital solutions. Stablecoins aren’t a silver bullet, but they provide a simple, borderless way to store and move value. In this series, we’ll travel across the region to explore how each country could harness stablecoins to boost prosperity.

Over the next few weeks we’ll be diving in to some case studies of select countries to discuss what we see as the road ahead. Join in the conversation, or sign up to our mailing list to stay tuned for our first stop: Zimbabwe, a country whose currency journey would make a roller coaster jealous.

Tinotenda Mapfumo

This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own research before making any investment decisions.